64% of Americans Aren’t Prepared For Retirement — and 48% Don’t CareSUNMARK LIFE STAGE ADVISORY HAS A SINGLE GOAL: TO HELP YOU MAKE THE MOST OF YOUR MONEY. GET EASY-TO-UNDERSTAND ADVICE AND GUIDANCE IN SUPPORT OF YOUR FINANCIAL GOALS.LEARN MORE

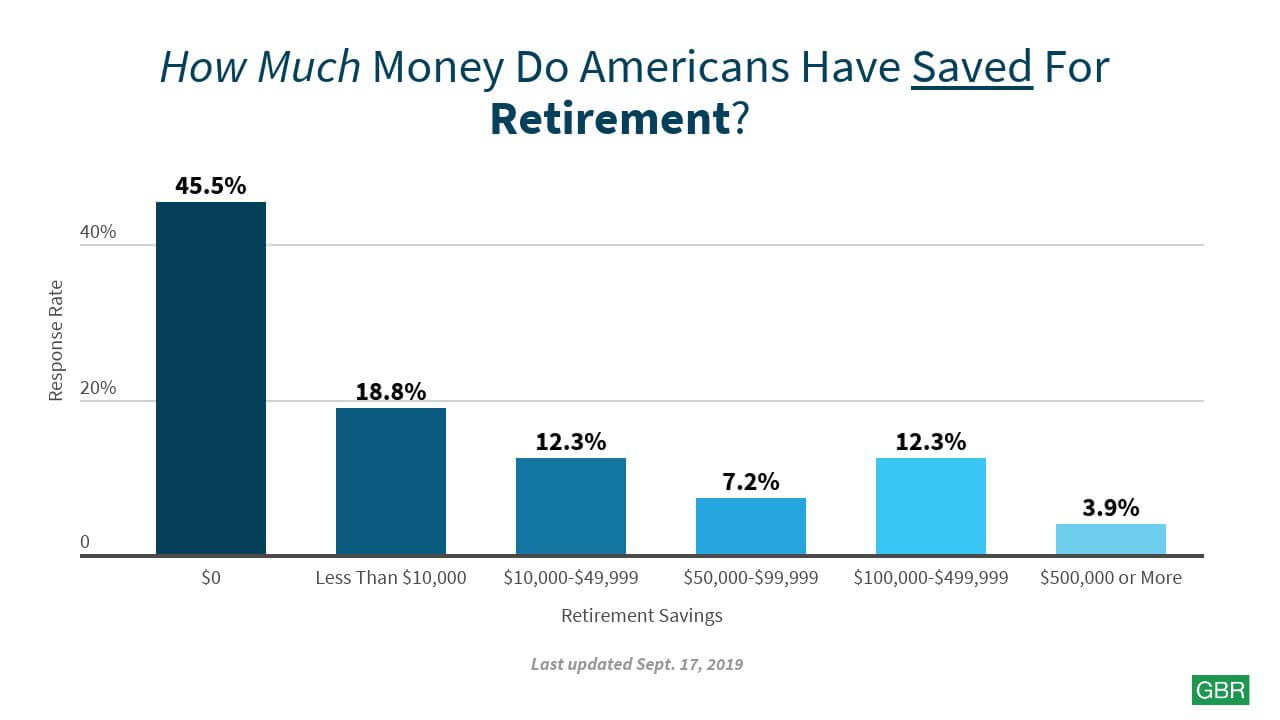

Retirement prospects seem grim for over half of America, according to the latest results of a GOBankingRates survey. The 2019 retirement survey revealed that even more people will retire broke than initially projected. GOBankingRanks asked over 2,000 respondents about their savings. Sixty-four percent of Americans are now expected to retire with less than $10,000 in their retirement savings accounts, versus the 42% reported back in January. Yet, the people at risk of a stormy retirement don’t seem to see it that way — nearly half of all survey respondents were not concerned about the size of their retirement savings accounts. Find out why many Americans are delaying saving for retirement. 64% of Americans Will Retire BrokeWhen asked to estimate how much money they had in retirement savings, close to half of all respondents — 45% — claimed they had no money put aside for retirement, while 19% said they’ll retire with less than $10,000 to their name. If these trends hold, that means 64% of all Americans will essentially retire broke. Twenty percent will retire with anywhere from $10,000 to $100,000. As for the remainder, well, let’s just say they have more wiggle room with their retirement savings.

Zero dollars was the most popular answer choice among respondents of all ages, though that percentage fell as age increased. Unsurprisingly, older respondents have more money saved since they had more time and potentially more avenues to do so. Men and women tied at 46% when it came to having $0 in retirement savings. However, men have more money than women in nearly all savings brackets. This could be due to men generally earning more than women, as well as the result of an investment gap. The survey also asked people why they thought they didn’t have enough retirement savings, with the top three responses being:

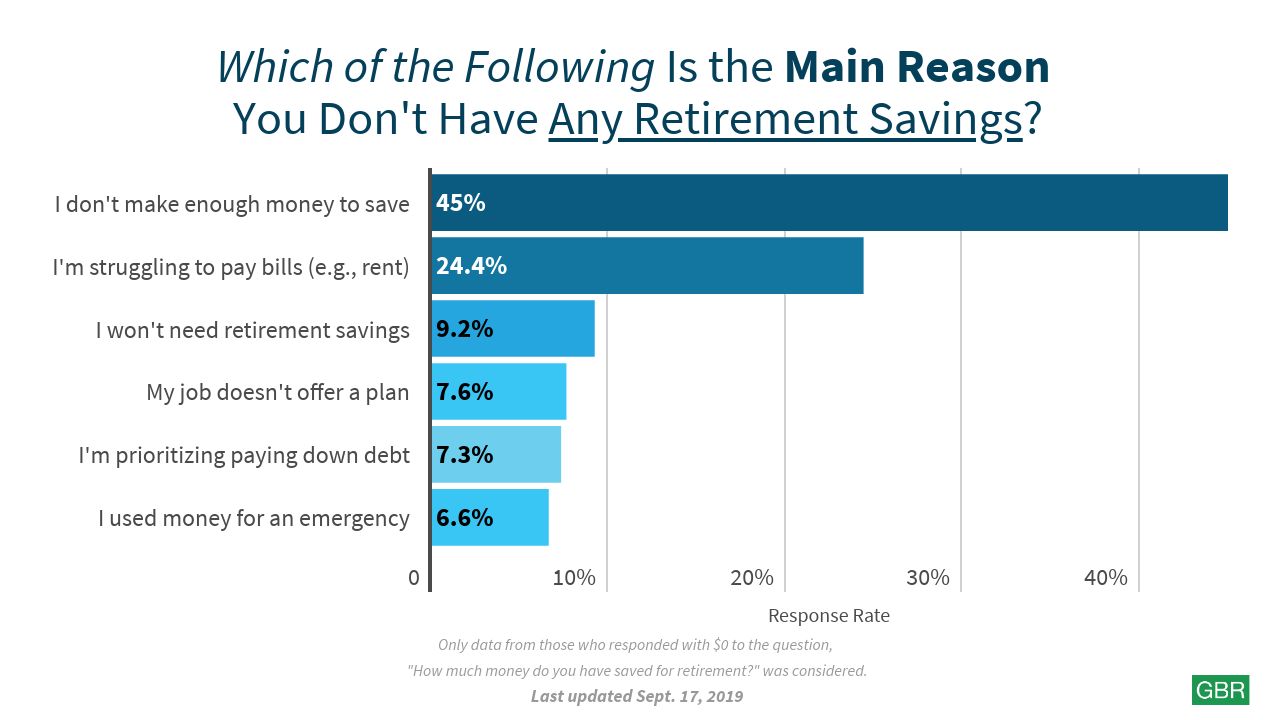

What About Americans With $0?People with $0 in their savings account have a good explanation for why nothing’s there: They don’t make enough money to save. Of those who fell in the $0 bracket, 45% said they couldn’t save for that reason. Bills are another big obstacle for 24% of respondents with no savings.

Interestingly, 9% of respondents with $0 in their retirement accounts said that they won’t need savings in their golden years, which may imply that they plan to continue working past retirement age. Read More: 50 Best (and Worst) Places To Retire If You Have No Savings Most People Use Savings Accounts for RetirementWhen it comes to the best way to save for retirement, 46% of people chose a savings account as their primary method, with the next most popular response being 401(k) accounts at nearly 30%. Only 14% of respondents chose individual retirement accounts or Roth IRAs. It’s disheartening that savings accounts are the most popular option because their growth rate is paltry. The current national return rate for savings accounts is 0.09%, according to the Federal Deposit Insurance Corp. Here’s how that rate stacks up against other retirement vehicles:

It’s harder to gauge the return rate for instruments like 401(k) accounts and IRAs because it depends on what assets you invest in through those accounts, how long you invest for and how much money you put into them. Furthermore, you should factor in whether inflation will affect your returns. Luckily, there are plenty of free online calculators to help you figure out what your return will be. Many Americans Don’t Care About Saving For RetirementNearly half of all respondents — 48% — were not bothered by how much they had saved up. What’s even more alarming is that over half of the respondents who claimed they had $0 in retirement savings expressed no concern over it. According to GOBankingRates’ survey, the younger you are, the less you care about having no savings. However, those who did care were more likely to respond with “I’m not able to save more” versus the alternative response, “I’m going to make changes to save more.” Forty-four percent of those ages 55-64 were concerned about having nothing saved but specified they were unable to save more. How Will Millennials and Generation Z Fare?Generation Z and millennial respondents are the most vulnerable to retiring broke. More than half in both age brackets said they had $0 in retirement savings, with 63% of Gen Zers and 54% of millennials ages 25-34 giving that response. Furthermore, those generations were the most likely to use savings accounts as a means for retirement, and the least likely to choose more efficient investing tools like 401(k) accounts and IRAs. Neither group is making enough money to save, with 47% of Gen Zers and 37% of millennials agreeing with that statement. Baby boomers are generally better equipped to handle retirement than their younger counterparts. Only 33% of respondents ages 65 and older claimed to not have anything saved, and 6% said they had $500,000 to $1 million in their retirement nest egg. However, older respondents were also more likely to rely on a spouse for their retirement plans. Related: These Are the 50 Best Cities for Gen Z To Live Well On a Budget Men and Women Don’t Make Enough Money To SaveSo, what’s the biggest problem getting in the way of retirement savings for both men and women? It’s a lack of money to save with, according to 32% of men and 33% of women. However, since men earn higher wages than women, on average, that may explain why over half of all male respondents are not concerned about retirement, versus 45% of women. Men were also more likely to say that they’ll make changes to save more. However, 37% of women said they cannot save more, versus only 27% of men. The survey revealed that more women than men rely on a spouse as part of their retirement savings plan. This is similar to the findings of a 2018 study conducted by UBS Wealth Management:

These trends don’t decrease with age. The same report from UBS found that 61% of millennial women are more likely to leave financial planning up to men, versus 54% of women from older generations. The Future of RetirementWhile younger generations still have time to build their savings, there is growing evidence that suggests retirement may no longer be a feasible option for many Americans. Northwestern Mutual’s Planning and Progress 2019 study found that 46% of working adults plan to work past the traditional retirement age of 65 due to financial concerns. According to a separate poll conducted by the Associated Press-NORC Center for Public Affairs Research, a quarter of Americans don’t expect to retire at all. Planning for the future is crucial. The amount of money needed to retire depends on several variables — some not entirely under your control — but most financial advisors will agree that $0 is definitely not enough. It’s important to put away some amount of money — preferably in a retirement savings vehicle offering a high interest rate, such as a 401(k) or an IRA — regardless of whether you plan to retire. While there is unfortunately little that can be done for those who want to save but cannot find the extra money, the results of GOBankingRates’ survey may indicate a change in attitudes toward retirement. More From GOBankingRates

Methodology: GOBankingRates conducted an online poll using Survata and surveyed 2,003 Americans from across the country using the following questions: (1) By your best estimate, how much money do you have saved for retirement? (2) What is the primary method you’re using to save for retirement? (3) Are you concerned about how much you have saved? (4) Which of the following is the main reason you do not have any retirement savings? and (5) Are you relying on a spouse or partner for your retirement? The survey ran from Aug. 27, 2019, to Sept. 3, 2019. This article originally appeared on GOBankingRates.com: 64% of Americans Aren’t Prepared For Retirement — and 48% Don’t Care SUNMARK LIFE STAGE ADVISORY HAS A SINGLE GOAL: TO HELP YOU MAKE THE MOST OF YOUR MONEY. GET EASY-TO-UNDERSTAND ADVICE AND GUIDANCE IN SUPPORT OF YOUR FINANCIAL GOALS.LEARN MORE

|

|

||||||||||||||

Routing #: 221379824

We are currently experiencing an outage with eStatements in our online banking and mobile app. We are working to resolve this issue as soon as possible. We apologize for any inconvenience.