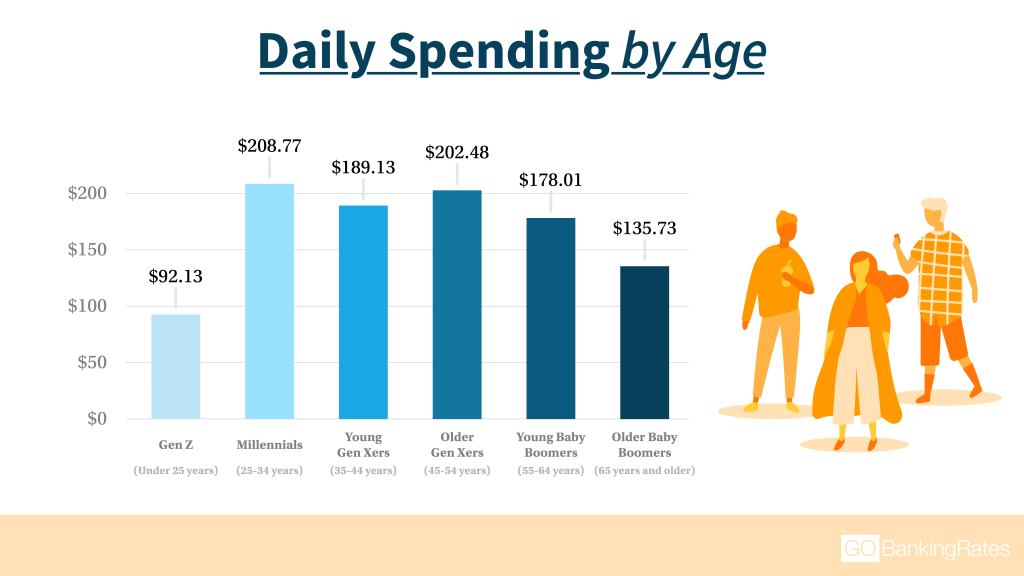

Here’s How Much the Average American Spends in a Day — How Do You Measure Up?Whether you’re just starting to build your financial life, you’re past retirement or you’re anywhere in between, it’s vital to track your spending habits. You should always know where your money is going, so you can adhere to your budget. When you’re first starting out, you’ll want to build a solid financial foundation, not one rife with debt. When you’re earning a decent salary from your career, funnel as much money as possible toward paying down mortgage debt and maximizing your retirement accounts. Finally, when you’re retired, you’ll want to pay off any remaining debt and free up money for necessary expenses that might arise. But one question you might ask yourself at every step of the way is, “How much does the average American spend per day — and where do I stack up?” GOBankingRates analyzed annual expenditure data from the Bureau of Labor Statistics in 15 categories covering both necessary and discretionary spending to find out how much the average American in each age generation spends in a day. Keep reading to find out where you stand within your age group and whether or not you’re guilty of bad spending habits that can bust your budget. Click to See: How Do Your Finances Measure Up to the Typical American’s? Average American Spending per Day: All Ages

So, how much does the average American spend on a daily basis in different categories? Overall, Americans spend the most on housing, followed by groceries, utilities, and health insurance. Younger Gen Xers — ages 35-44 — spend the most out of all the groups on housing and groceries, whereas older Gen Xers — ages 45-54 — spend the most on utilities. Older baby boomers — those ages 65 and older — spend the most overall on health insurance. Here is the breakdown by spending category:

Americans spend the least amounts overall on alcohol, pets and vehicle insurance. Gen Zers — those under the age of 25 — spend the least amount on alcohol, followed by older baby boomers. Gen Z also outlays the least amount on vehicle insurance and pet spending, followed by millennials — ages 25-34 — in both spending categories. Click to See: How Do You Stack Up to the Average Income in Your State? Average American Spending per Day: Under 25 Years Old (Gen Zers)

Americans under 25 years old spend the least in every category except for education, gasoline, cellphone service, and clothing. Although Gen Z puts the second most toward education spending — right after Older Gen Xers who are ages 45-54 — they spend less overall on gasoline, cellphone service and clothing than every other age group aside from older baby boomers. Gen Z men are more interested in spending money on products — such as technology, electronics, jewelry and clothes — than their female counterparts who are more interested in spending money on experiences, such as attending concerts, going to the movies or eating out with friends, according to the State of Gen Z National Research Study 2017 from the Center for Generational Kinetics. Related: Gen Z Is Heading Into the Workforce — And That’s a Good Thing for Everyone Average American Spending per Day: 25-34 Years Old (Millennials)

On a daily basis, millennials spend more overall than every other group, but they don’t spend the most or least in any one category. After older and younger Gen Xers, they spend the most on eating out and clothing. But those expenditures don’t always equal money well spent. According to Charles Schwab’s 2017 Cents and Sensibility study, 70 percent of millennials admitted to spending on clothes they don’t necessarily need and 60 percent of millennials say they spend more than $4 on coffee. What millennials spend on average on groceries each day is comparable to what baby boomers spend. But baby boomers spend much less per day on eating out than millennials: $6.88 vs. $9.36, respectively. Average American Spending per Day: 35-44 Years Old (Younger Gen Xers)

Younger Gen Xers — ages 35-44 — average daily grocery spending of $14.05 is more than all other age groups, which might lead you to believe that they spend much less than other groups on eating out. The group’s average daily eating out expenditures, however, are also the highest out of all age groups at $11.64. According to the Charles Schwab 2017 Cents and Sensibility survey, 66 percent of all Gen Xers are likely to spend money eating out at one of the hot restaurants in town, whereas only 40 percent buy coffee that cost more than $4 each. Identify Your Issues: 16 Biggest Financial Mistakes You’re Probably Making Average American Spending per Day: 45-54 Years Old (Older Gen Xers)

Older Gen Xers — ages 45-54 — have the second-highest overall daily spending average among all of the age groups, right after millennials. The difference is that although millennials don’t spend the most or least in any of the average daily spending categories, older Gen Xers spend the most overall in eight out of 14 of them. Education spending alone averages $3,213 per year for this group, which is by far the highest of all age groups. Other average daily spending categories where Gen Xers top the charts are gasoline, vehicle insurance, alcohol, entertainment, cellphone service, and pets. According to the Charles Schwab study, only 29 percent of Gen Xers surveyed — both young and old — admitted to spending money on taxis and Ubers, which might partially account for the higher gas expenditures. Find Out: How to Save Money on All Your Monthly Expenses and Bills Average American Spending per Day: 55-64 Years Old (Younger Baby Boomers)

Younger baby boomers — ages 55-64 — rank among the top three age groups for highest levels of average daily costs for alcohol, pets and entertainment spending, which are considered non-essential expenses. They also rank second in average daily spending for cash contributions. A separate GOBankingRates study found that baby boomers can avoid ruining their retirement by cutting unnecessary spending on alcohol, eating out, rideshares, coffee, clothing, and events — in half. For example, this age group could invest $2,098 per year and have $35,143 in savings by age 65 if they earn a 7 percent annual return. Average American Spending per Day: 65 and Older (Older Baby Boomers)

The average daily expenditures for health insurance and cash contributions are higher for older baby boomers — or those age 65 or older — than any other age group. However, gas, education, clothing and cellphone service spending for older baby boomers are the lowest among all age groups. A separate GOBankingRates study found that a big spending category for this age group is rides hares, which could explain the lower gas costs. The study also found that older baby boomers could save over $3,000 per year by eliminating unnecessary expenses, such as rides hares and eating out, which they should consider using to pay off any existing debts. How Much Should I Spend on Rent, a Car and Other Expenses?If you’re unsure about how much you should be spending on essentials (housing, transportation, groceries, etc.) and non-essentials (restaurants, entertainment, alcohol, etc.) consider using the 50/30/20 budgeting rule as a guide. According to this rule, here’s how you should allocate your after-tax income:

Understanding the difference between your wants and your needs is crucial to following any budget. Anything that you need to survive is a need, and anything that you can forgo without seriously sacrificing your quality a life is a want. Let’s assume that your monthly paycheck is $2,500 after taxes. Using the 50/30/20 rule, your spending might look something like this:

To master your budget, start keeping tracking of your daily, weekly and monthly spending. You can do this manually by writing down your purchases in a notebook. Or, use a budgeting app like Mint or Digit that can automatically track your spending for you and help you save up for your important financial goals. Click through for 16 expert tips to better manage your money. More on Saving Money and Budgeting

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Routing #: 221379824