These Are Americans’ Top Financial Priorities Heading Into 2020Americans are vowing to improve their finances in 2020, according to a new GOBankingRates survey on financial resolutions. Goals include paying down debt, slashing spending and dramatically boosting savings. But Americans’ resolve to manage their money better doesn’t mean that they’re overly concerned about their financial situation. In fact, the survey of 852 adults across the U.S. found that a majority of respondents said they aren’t worried about their personal finances in 2020. And, that’s worrisome. “There could be a level of denial involved,” said financial psychologist Dr. Brad Klontz. “It’s a good idea to be worried about your finances. People who have some anxiety about their money end up doing the best financially.” The results of this survey on financial resolutions also show that Americans might be overconfident in their ability to stick to their 2020 resolutions based on their ability to set and achieve past goals. The GOBankingRates survey covers the following topics:

Key Findings

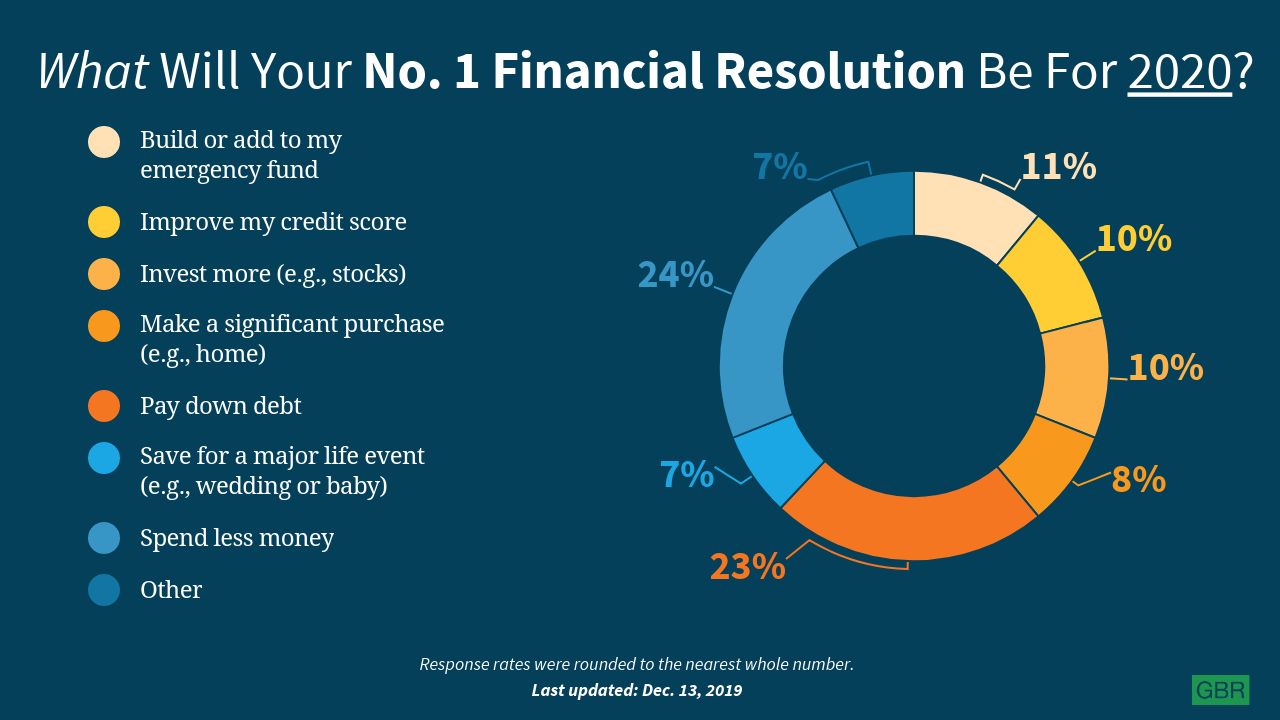

Nearly Half of Americans Want to Pay Off Debt and Spend Less MoneyWhen asked what their No. 1 financial resolution for 2020 will be, almost 24% of respondents said they want to pay down debt. Another 24% said that their top goal is to spend less money in 2020. The next two most popular resolutions are building an emergency fund and investing more. The top two resolutions actually go hand in hand, considering that many consumers might need to spend less in order to pay down debt. And consumers often need to tackle these issues before addressing other financial concerns. “Having debt can certainly hold consumers back from making other financial moves or reaching other goals,” said debt relief attorney Leslie Tayne. “As a result, it is certainly not surprising that consumers would set paying down debt as a financial resolution in order to rid themselves of the burden and be able to work toward other financial goals.”

The survey found that older adults were more likely to say that paying down debt was their top financial goal in 2020. Adults ages 55 to 64 had the highest percentage of respondents — 34% — who said this was their No. 1 goal. And women were more likely than men to say they wanted to pay down debt — 26% versus 21%.

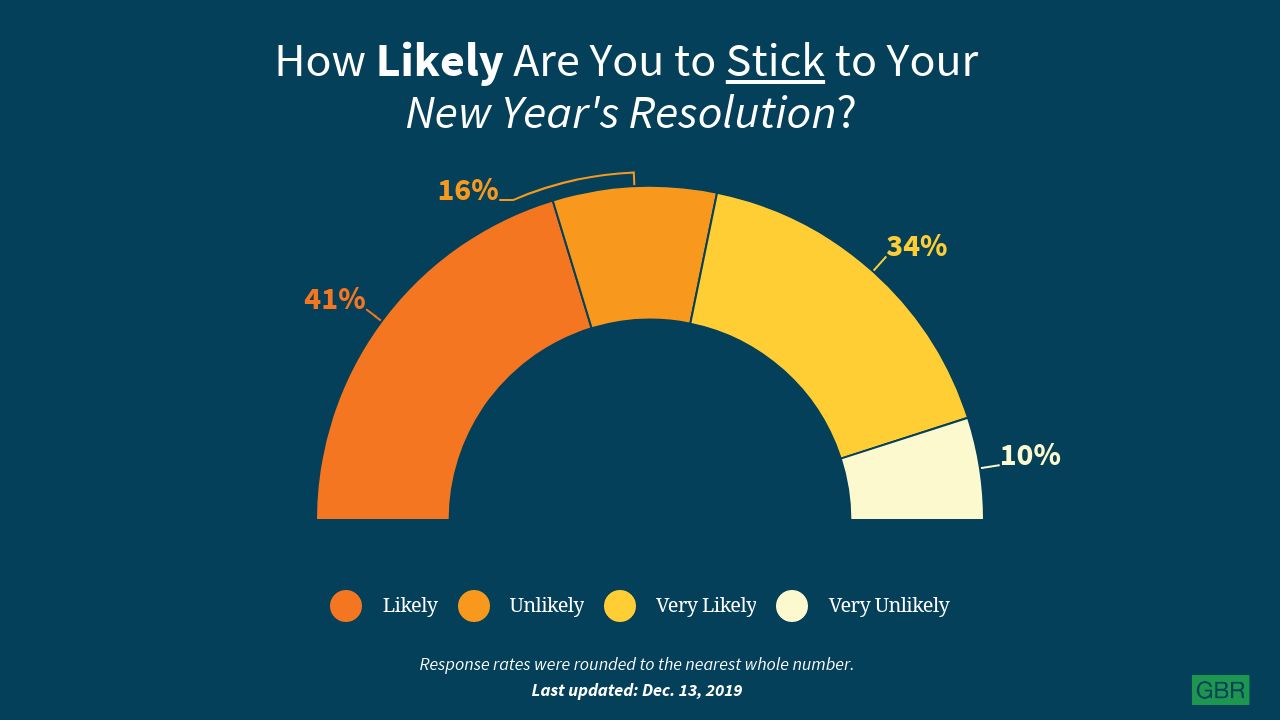

A separate GOBankingRates survey found that 58% of Americans said that debt will be the biggest roadblock to accomplishing their goals in 2020. To pay off what they owe, Americans will have to make enough room in their budgets to make more than the minimum payments on their debts, Tayne said. “Setting paying down your debt as a goal is all well and good, but to be truly effective in succeeding in that goal requires a well-thought-out, actionable plan that you hold yourself accountable in sticking to,” she said. Most Americans Think They’ll Stick to Their New Year’s ResolutionAmericans seem confident that they’ll keep their resolutions for 2020. About 75% of respondents said it’s likely or very likely they will stick to their resolutions — financial or otherwise. Only 10% said it’s very unlikely they’ll reach their goals for 2020.

Young adults ages 18 to 24 and older adults ages 45 to 54 were the most optimistic. About 78% of both age groups said they were likely or very likely to stick to a New Year’s resolution. And women were more positive than men — with 78% saying they were likely or very likely to keep a resolution versus 71%. Confidence is important for achieving goals, said Klontz, who has conducted studies on what impacts people’s ability to achieve financial goals. But there’s a line between confidence and overconfidence. “Overconfidence leads you to failure because you have a false perception of how easy it’s going to be and that might not inspire you to take the steps you need to achieve success,” he said. Americans Have an Ambitious Savings Goal for 2020When asked their target savings goal for 2020, the average amount respondents said they plan to set aside is $17,687. That’s close to the maximum contribution employees can make to a 401(k), 403(b) or 457 retirement savings plan in 2020, which is $19,500. It also would be a significant increase in savings over what many Americans currently have stashed away. GOBankingRates’ annual retirement savings survey found that 46% of respondents had nothing set aside for retirement, and 19% said they had less than $10,000. And GOBankingRates’ latest savings survey found that 69% of respondents said they have less than $1,000 in a savings account. The financial resolutions survey found that young adults ages 18 to 24 have the loftiest savings target: $24,447, on average. And men are much more ambitious than women — with an average savings target of $25,408 versus $10,449.

It’s good to set a goal that pushes you to save more, but it’s important for that goal to be achievable, Klontz said. Otherwise, you won’t follow through on your resolution because you’ll feel that it’s impossible to reach your goal. In fact, a survey by AARP found that 43% of adults who had resolved to save money in 2019 were already failing to maintain their resolution two months into the year. 60% of Americans Are Not Worried About Their FinancesAlthough Americans are resolving to take steps in 2020 to improve their finances, the survey found that 60% of respondents aren’t worried about their personal finances going into the New Year. Adults 65 and older seem to be the least concerned, with 66% of respondents in this age group saying they aren’t worried about their personal finances in 2020. And men are less likely to say they’re worried about their finances than women — 63% versus 57%. Although a majority of Americans said they aren’t worried about their finances, that doesn’t mean they have a handle on them. Instead, it might mean that they aren’t willing to admit that they need to be paying more attention to their finances, Klontz said. “Sometimes people aren’t ready to take action.”

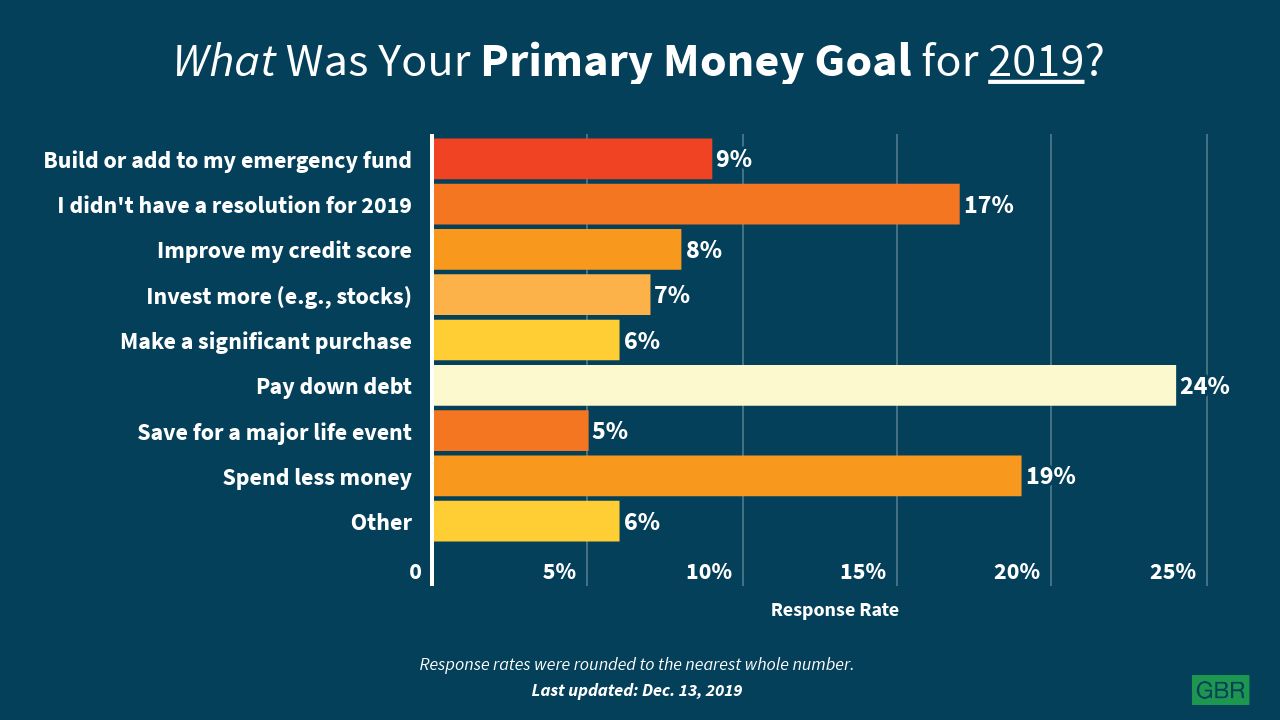

Although a majority claim not to be stressing about their finances, a large minority — 40% — are worried about their financial well-being. That’s actually an increase over the past year, when a GOBankingRates’ survey found that 25% of respondents said they were worried about their finances. Those who are worried might actually be in a better position to reach their financial goals in 2020, Klontz said. “If I was a betting man, I would put my money on the 40% who are worried,” he said. “That’s because they are aware there’s a problem, and their worry will help motivate them to take action.” But Only a Slim Majority Achieved Their 2019 Financial ResolutionAlthough an overwhelming majority of respondents expect to stick to a resolution in 2020, the most popular resolution for the coming year — paying down debt — also was the top goal for 2019. Clearly, some respondents had trouble reaching their goal. In fact, the survey found that just slightly more than half of respondents achieved their financial resolution in 2019. More than a quarter didn’t manage to keep their resolution. And 17% of respondents didn’t even have a financial resolution for 2019.

There might be a couple of reasons why those who vowed to pay down debt in 2019 are still resolving to do so in 2020. “In many cases, paying down debt extends beyond a one-year period,” Tayne said. “The same people who were setting it as a goal for 2019 may have made headway toward this goal, but may still have debt to pay off and are therefore still making it their resolution for 2020. However, others may be having trouble paying off what they owe if they have not adjusted their spending habits or budgets properly.” To pay down debt in 2020, Tayne said you first should figure out how much you owe and the interest rate on each debt. Then review your spending to find ways to cut back and put more money toward your debt. “Once you’ve freed up some funds, determine your pay down strategy,” Tayne said. You could opt to pay down the debt with the highest interest first, the highest balance, or the debt that causes you the most stress. Once you have a plan, hold yourself accountable by setting payment reminders, Tayne said. Keep a visual representation of your progress to motivate yourself to keep going. “Most importantly, your budget should be adjusted so that you don’t need to take on additional debt,” she said. “Nothing hinders your debt pay down progress more than adding more debt into the mix.” How to Reach Your 2020 Financial GoalsThe new year is a great opportunity to commit to improving your finances. To ensure that you actually stick to your resolutions, though, Klontz said you should take the following steps: Picture your goal. To increase your chances of achieving a goal, envision what reaching that goal would look like. “You want to engage your emotional brain,” which operates on images, Klontz said. So if you want motivation to boost retirement savings, for example, picture your ideal retirement. Be specific. Don’t simply resolve to pay down debt. You need to be more specific, and you need to set a timeline. For example, you could resolve to pay off all of your credit card debt by December 2020. Put your goal on autopilot. “Do what athletic clubs do — they automate your payments,” Klontz said. “The same thing works with paying off debt or saving more.” If you set up automatic monthly debt payments or contributions to a retirement account, you won’t have to think about taking action (and risk making excuses to not act). Find someone to hold you accountable. Share your resolution with people so they can check in to make sure you’re sticking to it. It’s especially important if you’re in a relationship for your partner to know about your goal so you can work on it together. Last updated: Dec. 16, 2019 More From GOBankingRates

Methodology: GOBankingRates surveyed 852 Americans ages 18 and older between Nov. 25, 2019, and Dec. 2, 2019, asking six different questions: 1) What will your No. 1 financial resolution be for 2020?; 2) What is your overall target savings goal for 2020?; 3) Are you worried about your personal finances in 2020?; 4) What was your primary financial goal for 2019?; 5) Did you achieve your financial resolution in 2019?; and 6) How likely do you think you are to stick to a New Year’s resolution (financial or otherwise)? All respondents had to answer “Yes” to the screener question: “Do you have a financial resolution (i.e., a priority) for 2020?” GOBankingRates used Survata’s survey platform to conduct the poll. This article originally appeared on GOBankingRates.com: Survey: These Are Americans’ Top Financial Priorities Heading Into 2020

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Routing #: 221379824